3 Things Every Horse or Farm Owner Should Know

I often equate insurance to a parachute… you rarely need it; but when you do, the difference in correct coverage can have a significant impact on your life. Finding the right agent, the right coverage, and maintaining your policies has never been more critical. Here are 3 things every horse or farm owner should know.

- Liability is a shield to protect your assets and income. The greater your net worth, the bigger the shield you should carry. If your actions or owned property is responsible for someone’s bodily injury or loss of property, you can be held liable. Depending on how severe the case, this can be sorted out in the courts. Everything you own, including your income can be called into question when determining your net worth.

- Not all liability protection is created equal. A standard homeowner policy does not protect against commercial or business pursuits – activities done in exchange for money (i.e. training, boarding, lessons of horses). True farm policies have the “products and completed operations” endorsement to extend liability to cover farm exposures.

- Lastly, farm stuff is NOT personal property. Your farm stuff is only covered for loss if it’s listed on your policy. Some homeowner policies have minimal allowances for specific items, such as $1500 for tack. The personal property portion of your home policy is for the contents of your home. Insuring your farm stuff can be done with endorsements on the farm policy.

Most people we work with don’t initially have the right coverage. Insured and unprotected is what we call it. Luckily, fixing these things is less painful than most people think. If your agent doesn’t know the difference between a skid steer and a scared steer, you should steer clear!

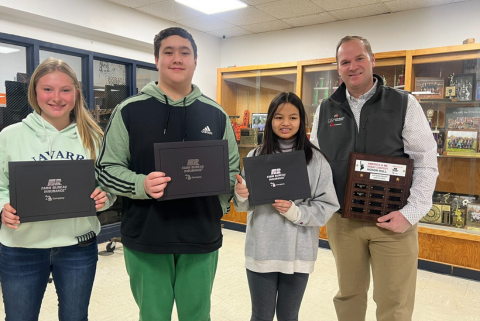

Jason Scramlin is a lifelong owner of horses and livestock, as well as a Marine Corps veteran, and Michigan State graduate. The Scramlin Agency specializes in farm coverage, as well as home, auto, life, and commercial. If you have questions about your current coverage, reach out to our agency: (269) 496 -9141